CAGR for TTDI Terrace Houses in the Last 10 Years

Introduction

When it comes to property investment, trends can look noisy year by year. Prices go up, dip slightly, then climb again. That’s where CAGR (Compound Annual Growth Rate) comes in.

CAGR smooths out the bumps and tells us the true pace of growth over time. For homeowners and investors in Taman Tun Dr Ismail (TTDI), it answers the big question: how much have terrace houses here really appreciated in the last decade?

TTDI has long been one of Kuala Lumpur’s most sought-after neighbourhoods. Mature, well-connected, and community-driven, its terrace homes remain a rare and desirable commodity. Let’s break down the numbers.

What is CAGR and Why It Matters?

CAGR measures the average annual rate of growth between two points in time. Instead of being distracted by short-term dips or spikes, it shows you the steady climb.

For investors, this means clarity. For homeowners, it’s proof of long-term value.

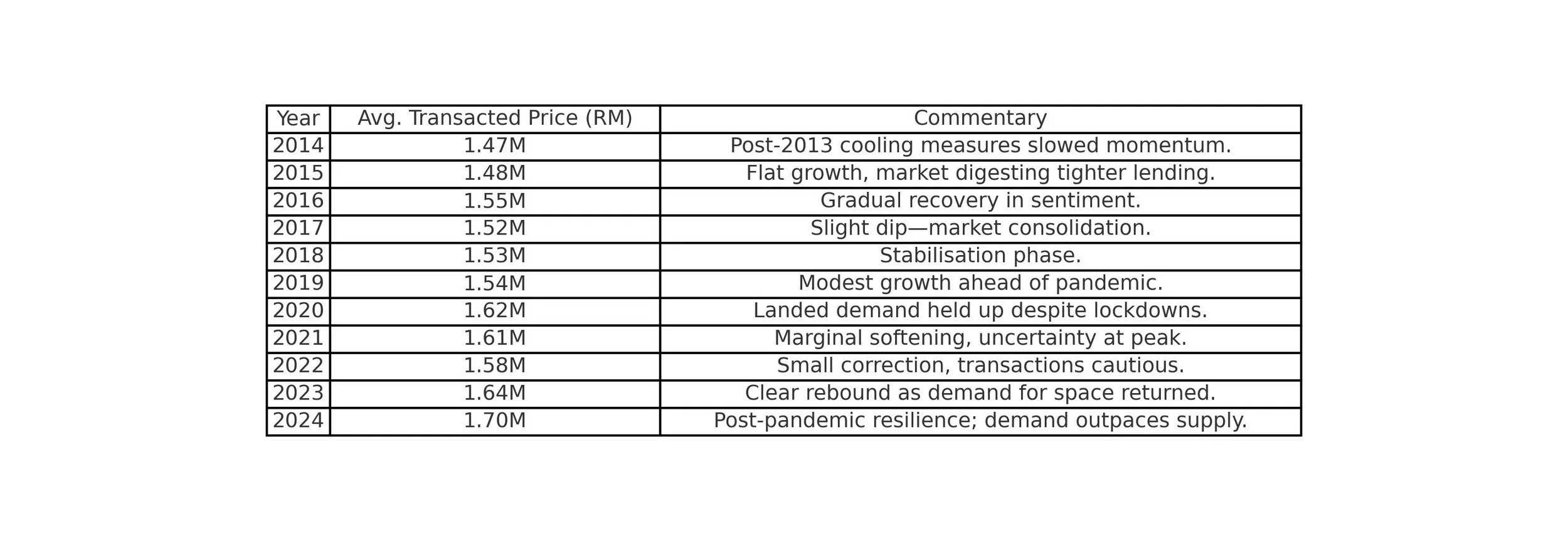

TTDI Terrace Homes: 2014–2024 Price Trends

We analysed actual transactions across TTDI’s main streets (Aminuddin Baki, Athinahapan, Datuk Sulaiman, Burhanuddin Helmi, Rahim Kajai, Zaaba). By using yearly medians and a 3-year rolling average, we minimise outliers and noise.

Over the last 10 years, TTDI terrace homes have recorded a CAGR of ~1.5%, reflecting stable long-term growth and resilience through multiple market cycles.

CAGR for TTDI Terrace Homes (2014–2024)

· 2014 average price: RM 1.47M

· 2024 average price: RM 1.70M

· CAGR: ~1.5% per year

Over a decade, TTDI terrace homes have delivered consistent, steady appreciation. Not spectacularly fast, but remarkably resilient compared to KL’s more volatile markets.

Recent Appreciation: 2021–2024

The pandemic reshaped housing demand. More families wanted landed homes with space—and TTDI terrace houses tick all the boxes.

· 2021–2024 Price Trend: RM 1.61M → RM 1.70M

· That’s ~2% per year—higher than the 10-year CAGR.

If we chart it:

This shows that recent years outperformed the 10-year average, signalling strong demand pressure in today’s market.

What’s Driving TTDI Terrace House Growth?

1. Location advantage – MRT, highways, and established amenities.

2. Limited supply – only 2,323 2-Storey terrace homes; No meaningful new terrace supply; renovations can upgrade quality but don’t add units.

3. Community appeal – parks, cafés, schools, and a walkable lifestyle.

4. Macro trends – pandemic shift toward space, plus KL’s broader landed scarcity.

Future Outlook: 2025 and Beyond

Analysts expect KL landed homes to remain firm, and TTDI is at the top tier of scarcity.

Catalysts ahead: further lifestyle upgrades, demand from younger families, MRT accessibility.

Expected trend: CAGR in the next 5–10 years may hold steady around 1.5–2% annually, with potential spikes in low-supply years. Higher range is plausible for median TTDI terraces, with renovated, well located units sometimes clearing higher.

For owners, that’s security. For buyers, it’s opportunity—especially while inventory remains thin.

Conclusion

TTDI terrace houses have appreciated at a steady ~1.5% CAGR over the last decade. Resilient through cooling measures, a pandemic, and multiple market cycles, they remain one of Kuala Lumpur’s safest long-term property plays.

If you’re looking for a home that preserves capital and provides daily quality of life, TTDI landed is still in a league of its own.

📩 Thinking about buying or selling in TTDI? Reach out—we’ll share current listings, on-the-ground street insights, and a clear picture of value. In the meantime, you can also explore TTDI Terrace Houses by Yin Homes to get a feel for what’s available today.

FAQ

Q1. What is the CAGR for TTDI terrace homes in the last 10 years?

~1.5% per year (2014–2024).

Q2. How do you calculate CAGR for TTDI terrace houses?

Using the formula: (End value/ Beginning value) ^1/n -1

Q3. What has been the recent appreciation rate?

About 2% per year from 2021–2024.

Q4. Is TTDI a better investment than Bangsar or Damansara Heights?

TTDI offers stronger turnover and family demand; Bangsar and Damansara Heights may see higher volatility.

Q5. Will prices continue to rise in the next 5 years?

Yes, steady demand and low supply should sustain growth.

Q6. What factors influence CAGR in TTDI?

Supply scarcity, MRT connectivity, and lifestyle demand.

Q7. Is now a good time to buy?

Yes, especially for long-term holding—supply is low, and recent trends show stronger-than-average growth.