Is Investing in TTDI Properties a Better Inflation Hedge Than Fixed Deposits (FD)?

Inflation is the quiet kind of stress. Nobody wakes up excited about it, but everyone feels it—food costs creep up, services get pricier, and suddenly “same salary, same savings” doesn’t feel the same anymore.

When inflation rises, what most people are really trying to protect is purchasing power: the ability for your money to still buy a decent life in the future.

That’s why investors look for an inflation hedge—an asset that tends to hold value (or grow) when the cost of living rises.

So here’s a very Malaysian, very practical question:

Is investing in TTDI properties a better inflation hedge than putting money into Fixed Deposits (FD)?

TTDI (Taman Tun Dr Ismail) is one of Kuala Lumpur’s most established neighbourhoods—consistently in demand, especially for families who want convenience + liveability. FD, on the other hand, is the classic “safe and steady” option—low drama, predictable returns, and highly familiar.

This article breaks down both options clearly, with the real trade-offs (because every “safe” option has a hidden cost somewhere).

What is an inflation hedge, really?

An inflation hedge is an investment that helps your wealth keep up with rising prices, so your savings don’t quietly lose real value over time.

Inflation doesn’t need to be extreme to matter. If inflation is 3% and your return is 2%, you didn’t “lose money”… but your purchasing power shrank.

Common inflation hedges include real estate, stocks, commodities, and sometimes gold. Today we’re focusing on:

· TTDI properties (a real asset, with potential capital appreciation + rental income)

· Fixed Deposits (FD) (fixed/known interest, bank-based, generally low risk)

TTDI properties as an inflation hedge (why it can work)

TTDI isn’t a “new hot area.” TTDI is the kind of neighbourhood people stay loyal to.

It has the stuff that holds demand together across cycles:

· established infrastructure

· lifestyle convenience (schools, parks, shops, F&B)

· strong connectivity to key KL areas

· that “residential calm” feeling that’s hard to replicate

Why property can hedge inflation

Property tends to hedge inflation through two engines:

1) Capital appreciation (the long-game engine)

Property prices usually move slower than stocks—but over longer periods, strong locations can compound well.

2) Rental income (the cashflow engine)

Rents can adjust upward over time, especially in locations with steady tenant demand. Not instantly, and not every year—but rent is one of the ways real estate “reprices” alongside inflation.

So TTDI properties can behave like a hedge because:

· the asset value can rise over time

· the income (rent) can rise over time

· and the neighbourhood has durable demand

But here’s the honest part:

Property hedges inflation better in the long run, not in the short run. And it comes with holding costs and patience requirements.

Fixed Deposits (FD) as an inflation hedge (what it does well, and where it fails)

FD is the comfort-food of Malaysian finance. It’s familiar. It feels safe. It’s predictable.

What FD actually is

A Fixed Deposit is a bank deposit where you lock in your money for a set tenure (e.g., 1 month, 3 months, 12 months) and earn a fixed interest rate. It’s considered low risk, especially when placed with member banks covered under Malaysia’s deposit insurance.

Malaysia’s deposit insurance (PIDM) protects eligible deposits up to RM250,000 per depositor per member bank (and the limit includes principal + interest/return).

The inflation problem with FD

FD protects you from volatility, but it doesn’t automatically protect you from inflation.

· If FD rate > inflation, you preserve (or slightly grow) purchasing power.

· If FD rate < inflation, your money is still “safe”… but it’s shrinking in real terms.

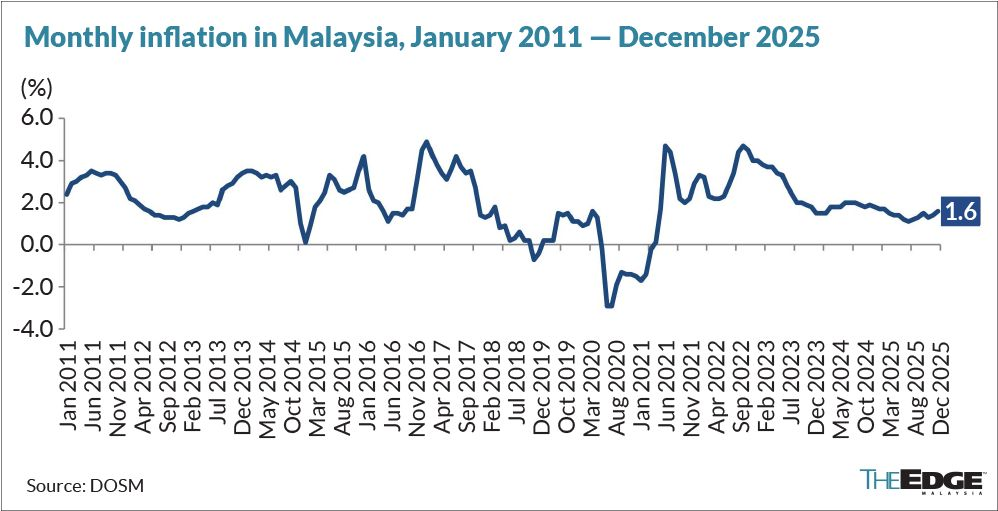

According to Department of Statistics Malaysia (DOSM), Malaysia’s inflation was reported at 1.4% in November 2025 (YoY).

Malaysia’s December inflation rises 1.6% on higher personal care and education costs (official data: https://theedgemalaysia.com/node/789844)

Meanwhile, FD promo rates can vary widely by bank, tenure, and campaign timing (you’ll see promotional ranges and “fresh funds” campaigns in the market).

FD isn’t “bad.” It’s just doing a different job:

· FD = capital stability + predictable interest

· Property = long-term compounding + inflation repricing potential

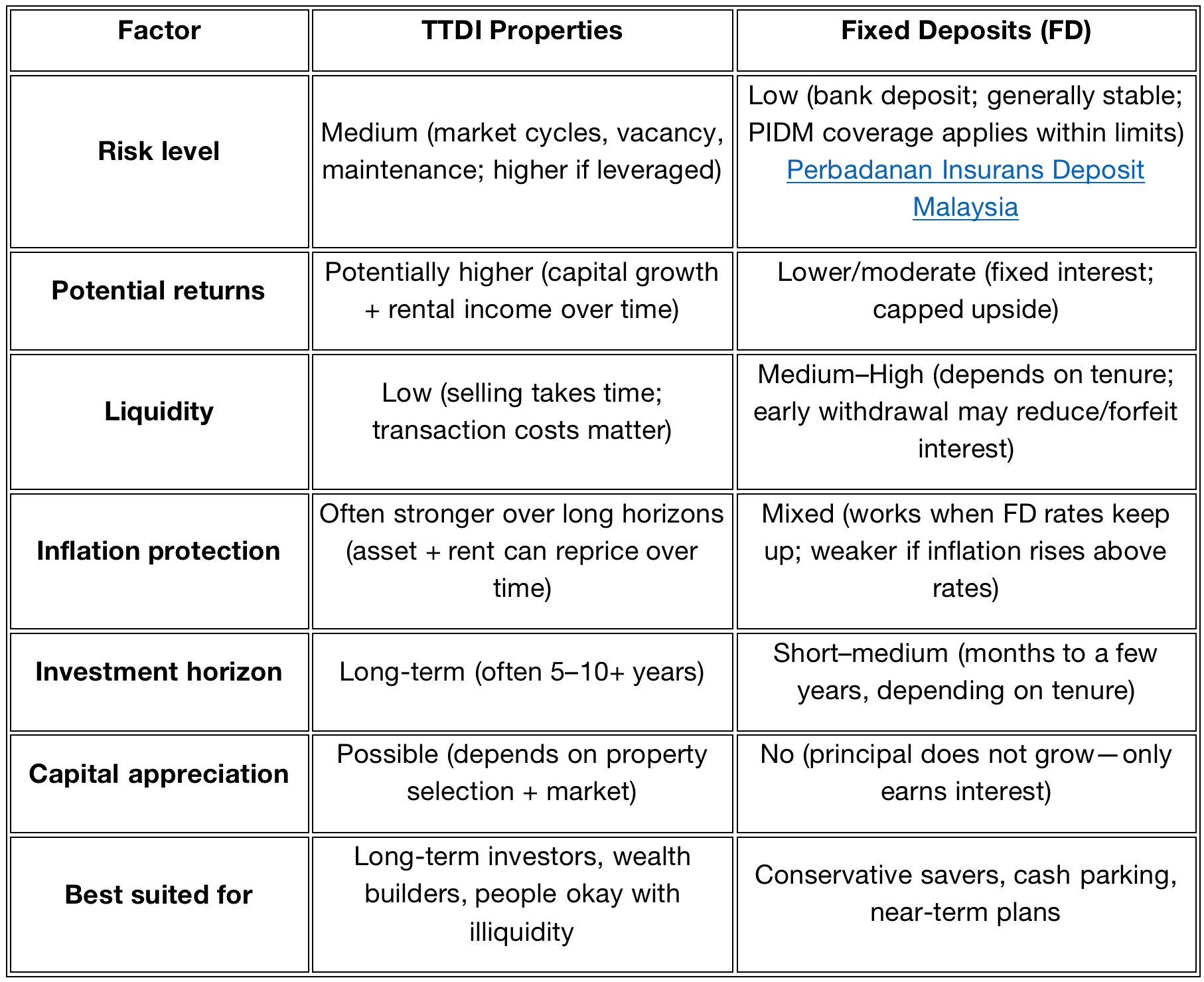

TTDI properties vs FD (simple comparison)

Risks (because every option has a catch)

Risks with TTDI property

· Illiquidity: selling quickly often means compromising price.

· Holding costs: repairs, maintenance, assessments, insurance, upgrades.

· Vacancy/tenant risk: rental income is earned, not guaranteed.

· Loan risk: leverage magnifies ups and downs.

· Market cycles: property can go sideways for periods.

Risks with FD

· Inflation risk: the biggest one—real value can shrink if rates don’t keep up.

· Reinvestment risk: when your FD matures, new rates may be lower.

· Liquidity constraints: early withdrawal can reduce the effective return.

Who should consider TTDI properties as an inflation hedge?

TTDI property tends to suit you if:

· you’re thinking 5–10+ years

· you want your wealth to have a shot at outpacing inflation

· you’re okay with the reality that property is not “tap and withdraw”

· you value durable neighbourhood demand more than hype

Who should choose FD instead?

FD tends to suit you if:

· you need the money relatively soon (1–24 months)

· you want capital stability and predictable returns

· you’re building a safety buffer (emergency fund, downpayment parking, renovation budget)

· you don’t want admin (tenants, repairs, timelines)

Yin Homes’ take: why TTDI holds up (when you buy the right one)

TTDI’s strength isn’t “price goes up every year.” That’s not reality.

TTDI’s strength is resilience—because people genuinely want to live here, not just invest here.

In our experience, TTDI “inflation hedge” behaviour is strongest when the home has:

· a layout that stays liveable through life stages (not just pretty photos)

· real value-add potential (smart renovation scope, extension/rebuild angle)

· good micro-location (street matters in TTDI more than most people expect)

A TTDI property bought with the right timeline and fundamentals tends to behave like long-term wealth protection. A TTDI property bought with short-term expectations tends to feel like stress.

FAQ: TTDI vs FD (what people ask us most)

1) “Should I move all my FD money into TTDI property?”

No. That’s not a plan—that’s a swing. Many people do better using both: FD for liquidity, property for long-term compounding.

2) “Does TTDI always beat inflation?”

Nothing always does. But established, in-demand neighbourhoods often have better odds over long horizons because the asset and rent can reprice over time.

3) “FD is safer, right?”

FD is safer from market swings. But FD is not automatically safe from inflation—real value can still erode depending on the rate environment.

4) “What if I need my money in 1–2 years?”

Then property is usually the wrong tool. FD fits better for short timelines.

5) “What TTDI properties hedge best?”

Usually the ones with strong fundamentals: liveable layout, good street, realistic value-add potential, and not overpriced for condition.

Conclusion: TTDI properties or FD?

If your goal is long-term inflation protection, TTDI properties generally have the stronger case because they can compound through asset value + rental income over time.

If your goal is short-term stability and flexibility, FD wins because it’s predictable and low drama.

Many smart households blend both:

· FD for safety + upcoming plans

· TTDI property for long-term wealth resilience

If you’re considering TTDI properties as part of your long-term inflation hedge strategy, Yin Homes can help you evaluate which property type and micro-location fits your timeline, and which options look attractive but don’t hold up on fundamentals.

Disclaimer: This article is for educational purposes and does not constitute financial advice. Investment outcomes vary and past performance does not guarantee future results.