CAGR for TTDI Single-Storey Homes in the Last 10 Years (2016–2025)

If you’ve owned a single-storey house in TTDI for a while, you’ve probably wondered:

“How much has my house really grown in value over the last 10 years?”

To answer that properly, you can’t just look at one hot year or one slow year. You need to zoom out.

That’s where CAGR — Compound Annual Growth Rate — comes in. It tells you how much prices have grown per year on average over a period of time, even when individual years jump up and down.

At Yin Homes, we analysed actual JPPH / Brickz transactions for single-storey homes on three core TTDI roads:

· Aminuddin Baki

· Burhanuddin Helmi

· Abang Haji Openg

from 2016 to 2025.

Here’s what the numbers say about long-term growth for TTDI’s classic 1-storey homes.

A quick refresher: What is CAGR?

Ignore the math for a second and think of it this way:

If a house was RM 1.0M ten years ago and similar homes today sell for RM 1.3M, prices didn’t move in a perfect straight line. Some years were flat, some up, maybe one or two down.

CAGR answers this question:

“If the price grew at a steady rate every year, what % per year would get me from RM 1.0M to RM 1.3M over 10 years?”

That % is the CAGR.

Why this matters for single-storey TTDI homes:

· Transactions are limited.

· A few sales can make a year look unusually high or low.

· CAGR helps you see the true long-term trend instead of being misled by one “record” sale.

TTDI Single-Storey Homes: The Market in Context

Single-storey homes in TTDI are a bit of a unicorn:

· Mostly built decades ago, on freehold land.

· Usually more compact built-up than double-storey homes, but still sitting on solid land sizes.

· Highly sought after by:

o Elderly parents who want to avoid stairs

o Families wanting a “forever home” they can rebuild later

o Buyers who value land and location over built-up

There is no new supply of true 1-storey landed homes in TTDI. What exists today is what you get — and over time, many of these homes will either be:

· Extended heavily, or

· Fully rebuilt into 2-storey or 2.5-storey houses

So understanding their long-term price trend is useful whether you’re planning to sell now or hold and rebuild later.

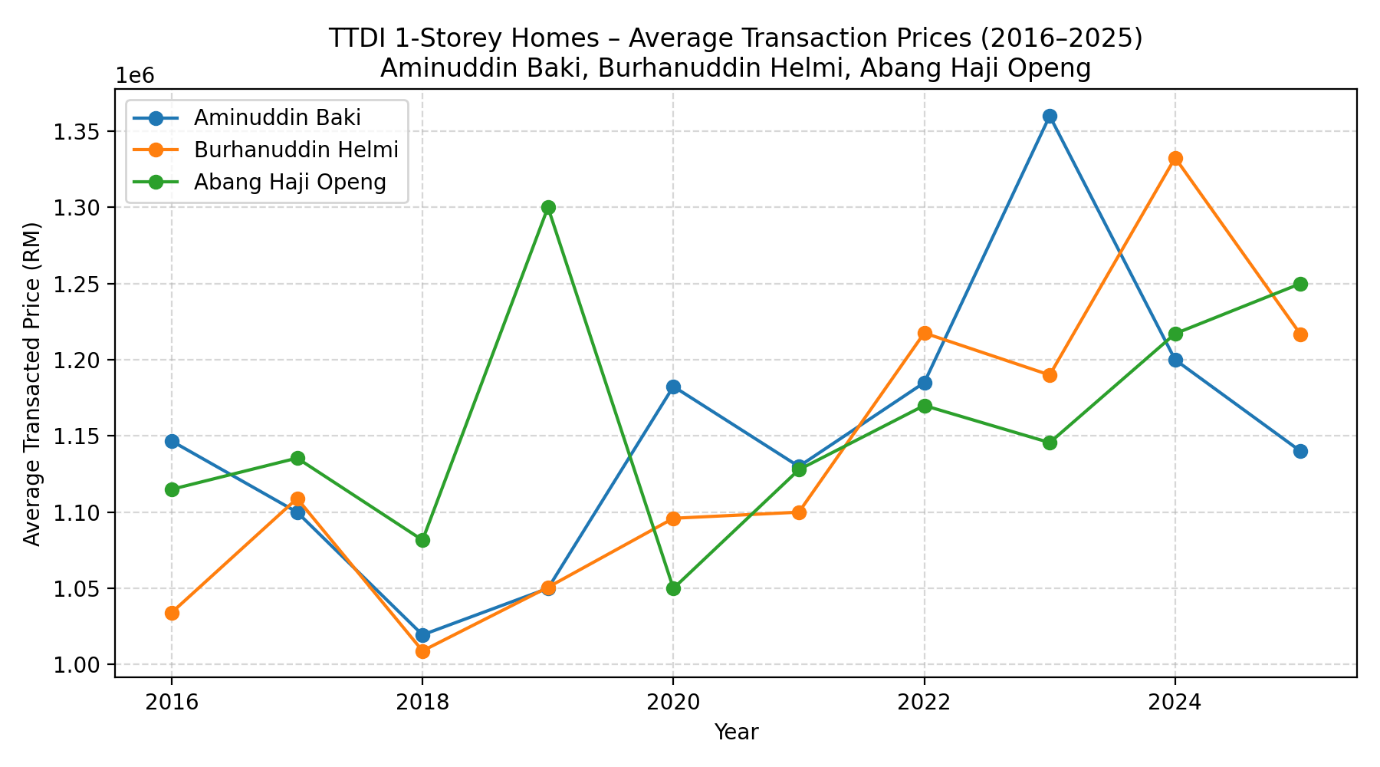

What the Data Shows: 2016–2025 Price Trends

Using your JPPH simple files, we calculated the average transacted price by year for single-storey homes on Aminuddin Baki, Burhanuddin Helmi and Haji Openg, then derived the CAGR from 2016 to 2025.

Here’s the summary (rounded for simplicity):

Overall (All 3 Roads Combined)

· 2016 average price: ~RM 1.10M

· 2025 average price: ~RM 1.20M

· CAGR (2016–2025): ~1.0% per year

So across this sample, TTDI 1-storey homes have shown steady, modest growth — not a bubble, not a crash.

Now the more interesting part: how each road behaves.

Street-by-Street: Aminuddin Baki, Burhanuddin Helmi, Haji Openg

1. Aminuddin Baki – Essentially Flat Over 10 Years

· 2016 average: ~RM 1.15M

· 2025 average: ~RM 1.14M

· CAGR: about –0.1% per year (basically flat)

Over the full 10-year period, single-storey prices on Aminuddin Baki are more or less where they started, once you smooth everything out.

This doesn’t mean nothing happened — there were still ups and downs in between — but if you compress 2016–2025 into a single number, the long-term growth is flat.

Key takeaway:

Aminuddin Baki 1-storey homes have held their value, but they haven’t “run away” in price the way some people assume.

2. Burhanuddin Helmi – Solid, Moderate Growth

· 2016 average: ~RM 1.03M

· 2025 average: ~RM 1.22M

· CAGR: about 1.8% per year

Burhanuddin Helmi shows healthy, moderate appreciation. Over nine years, that ~1.8% p.a. compounds into a meaningful gain, without looking like a speculative spike.

Likely drivers:

· Mix of owner-occupied units and investor stock

· Good accessibility and amenities along the road

· Progressive upgrades and renovations over time

Key takeaway:

Owners here have enjoyed slow and steady capital growth, especially if they bought earlier and also improved their homes.

3. Abang Haji Openg – Stable, Gradual Appreciation

· 2016 average: ~RM 1.12M

· 2025 average: ~RM 1.25M

· CAGR: about 1.3% per year

Haji Openg sits between Aminuddin Baki and Burhanuddin Helmi:

· Not flat like Aminuddin Baki

· Not as strong as Burhanuddin Helmi

· But still gradually trending upward over the decade

Key takeaway:

If you’ve held a 1-storey house on Haji Openg, the data suggests a stable, gently rising value curve, again assuming a normal, liveable condition.

So… are TTDI Single-Storey Homes “Good Investments”?

Depends what you mean by “good”.

If you want:

· 30–40% gains in a few years

· Big, quick jumps driven by speculation

…then TTDI single-storey homes are not that asset. The data is clear: growth has been modest but resilient, in the 0%–2%+ per year range depending on road.

But if you want:

· A freehold landed home in a blue-chip KL neighbourhood

· A long-term store of value that keeps up reasonably with inflation

· A “land bank” you or your kids can rebuild on later

…then the numbers support the idea that TTDI 1-storey homes are exactly that: boring, sensible, and very hard to replace.

What This Means if You’re Selling a 1-Storey TTDI Home?

The long-term CAGR story tells you a few things:

· Your home’s value hasn’t exploded, but it hasn’t collapsed either.

· The real upside often comes from:

o Good renovations

o Clear presentation

o Smart pricing for the current market

Buyers pay more when they can see:

· A layout that makes sense (or obvious potential to reconfigure)

· Solid basics: roof, wiring, plumbing in reasonable shape

· A home that feels well cared for, even if it’s older

If you’re an owner, your edge is:

· Scarcity: true 1-storey landed homes in TTDI are finite.

· Land: people are willing to pay for the option to extend or rebuild later.

How Yin Homes helps sellers:

· We price based on real transaction data by road, not wishful thinking.

· We highlight your home’s future potential (extensions, rebuild, multi-gen use).

· We tell the story in a way that speaks to the right buyers — not just anyone scrolling.

What This Means if You’re Buying a 1-Storey TTDI Home?

From the buyer’s side, a ~1.0% overall CAGR with some roads doing 1.3–1.8% says:

· This isn’t a “flip in 18 months” kind of asset.

· It’s a long-hold, lifestyle + wealth preservation decision.

If you’re shopping for a 1-storey home in TTDI, pay attention to:

· Road profile – some roads simply trade better.

· Lot shape & frontage – does it lend itself to future extensions or a rebuild?

· Micro-location – convenience to TTDI’s commercial pockets, schools, and parks.

Instead of only asking, “Can I get a bargain?”, ask:

“Will this home still feel like a good decision 10–15 years from now, if I extend or rebuild?”

How Yin Homes helps buyers:

· We bring actual past sales into your decision, so you know if a price makes sense.

· We walk through what it might cost to extend, modernise or fully rebuild.

· We match you to roads and houses that fit your real life, not just your search filter.

Yin Homes Featured TTDI Single Storey Homes

Well-kept, owner-occupied single storey in TTDI’s Abang Haji Openg enclave with a practical split-level (“split up”) layout that separates living and dining for easy day-to-day flow.

Overall condition is good. A solid, honest home with straightforward upgrade potential in a mature, sought-after street. Suitable for light refresh or as a clean base for a fuller renovation.

Find your perfect residence! This beautiful 1-storey terrace home is on the market. Situated in the vibrant area of Taman Tun Dr Ismail, Kuala Lumpur, this property is ready for you.

Seize the opportunity to acquire this charming home in a sought-after part of KL. This endlot offers so much in terms of turning it into a home because of its high ceiling, quiet location and opportunity for natural light throughout the home without compromising the built-up.

The best part is that it has a flatline layout so no more steps in your home. Just a touch of refurbishment or a complete overhaul - you'd find that this home has much to offer.

Fresh out of the oven : this newly renovated single storey home is up for sale. All piping and wiring are done - new kitchen cabinets - new appliances and new built-ins : get your furniture and move right in to this cozy single storey home. The location is quiet and convenient with no negative factors. The home can park two cars or if you prefer, create your own garden and park the cars outside because there's ample parking with wide roads.

All in all, the perfect home for those who don't want the hassle of renovation but still desire the TTDI address.

Final Thoughts

Looking at 2016–2025:

· TTDI 1-storey homes have shown quiet, consistent resilience.

· Growth has been modest but positive overall, with differences by road.

· In a world of high-rise oversupply, these old single-storey houses are exactly the kind of asset that doesn’t get replaced.

If you:

· Own a 1-storey TTDI home and want a data-backed view of what it’s worth today, or

· Are hunting for a single-storey in TTDI for your parents, your kids, or your future rebuild,

Yin Homes can walk you through the numbers, streets and real trade-offs, so you’re not guessing.